Intellectual Property Protection in Ghana: Essential Guide for Businesses

Understanding Intellectual Property Basics

What is intellectual property?

Intellectual property (IP) encompasses the creative output of human intellect, including inventions, literary and artistic expressions, distinctive designs, symbols, names, and images used in commercial activities.

For businesses, IP represents one of the most valuable assets that can drive competitive advantage and long-term success.

Why is intellectual property important for my business?

Whether you're a startup developing innovative technology, an SME building brand recognition, or an investor evaluating portfolio companies, understanding and protecting intellectual property rights is crucial for long-term success and competitive advantage. IP constitutes valuable business assets requiring strategic management and can significantly impact business valuation and competitive positioning.

What laws govern intellectual property protection in Ghana?

Ghana's intellectual property framework operates under the following primary statutes:

- Patents Act, 2003 (Act 657) and Patent Regulations, 1996 (L.I. 1616)

- Copyright Act, 2005 (Act 690) and Copyright Regulations, 2010 (L.I. 1962)

- Trademarks Act, 2004 (Act 664) and Trade Marks Regulations, 1970 (L.I. 667)

- Industrial Designs Act (Act 660)

Patent Protection

What is a patent and what does it protect?

Patents protect inventions that provide technological solutions to identified problems.

It grants the holder exclusive rights to prevent others from making, using, or selling an invention within Ghana for a specified period.

What are the requirements for an invention to be patentable in Ghana?

For an invention to qualify for patent protection in Ghana, it must satisfy four fundamental criteria:

- Novelty: The invention must be entirely new and not previously disclosed to the public. Inventive Step: The invention must be non-obvious to someone skilled in the relevant technical field

- Industrial Applicability: The invention must be capable of being manufactured or utilized in any industry, demonstrating practical commercial value.

- Statutory Eligibility: The invention must not fall into excluded categories.

How long does patent protection last?

Patent protection extends for twenty (20) years from the filing date.

To maintain protection, you must pay annual maintenance fees throughout this period. Patents can be assigned, licensed, or transferred, and patent holders may pursue legal remedies including injunctions and damages for infringement.

Trademark Protection

What is a trademark?

A trademark is any word, symbol, device, sign, or combination that distinguishes your goods or services from those of competitors in commercial transactions. Think of it as your business's unique identifier in the marketplace.

How do I register a trademark in Ghana?

Trademark registration involves filing an application with the Trademarks Registry, specifying the goods or services you want to protect. The application will be examined for distinctiveness of the mark, absence of confusion with existing registrations, compliance with requirements under the Trademarks Act.

How long does trademark protection last?

Registered trademarks receive protection for ten (10) years from the filing date, renewable for consecutive ten-year periods upon payment of prescribed fees.

What can I do if someone infringes my trademark?

Trademark owners may institute civil proceedings for infringement, seeking injunctions, damages, and other remedies.

Trademark rights may also be assigned or licensed subject to statutory requirements.

Copyright Protection

What does copyright protect?

Copyright protects original expressions in literary, artistic, musical, audio-visual, choreographic, derivative works, and computer software programs created by Ghanaians or persons resident in Ghana.

What rights do I have as a copyright owner?

Copyright ownership grants both economic and moral rights over creative works.

How long does copyright protection last?

Protection duration varies according to authorship:

- Individual authors: Life of the author plus seventy years

- Joint authorship: Life of the surviving author plus seventy years

- Corporate authorship: Seventy years from creation or first publication

Strategic Business Considerations

How should I manage my intellectual property assets?

Intellectual property constitutes valuable business assets requiring strategic management.

Proper identification, protection, and exploitation of intellectual property can significantly impact business valuation and competitive positioning.

What due diligence should my business conduct regarding intellectual property?

Businesses must conduct appropriate due diligence to ensure:

- Freedom to operate without infringing existing rights

- Adequate protection of proprietary information

- Compliance with employee confidentiality obligations

- Effective monitoring and enforcement strategies

Can foreign individuals and companies protect their IP in Ghana?

Yes, Ghana's IP laws provide protection for both residents and non-residents.

What happens if I don't protect my IP in Ghana?

Without proper IP protection, you may risk losing exclusive rights to your innovations, brands, or creative works; Competitors freely using your unprotected IP and reduced investment attractiveness

Do I need separate protection for each type of IP?

Yes, different types of IP require separate applications and protection mechanisms.

Can I license my IP rights in Ghana?

Yes, IP rights can be licensed, assigned, or transferred subject to statutory requirements and proper documentation. Licensing agreements and IP transfers should be carefully structured with professional legal assistance to protect your interests and comply with Ghanaian law.

How does IP protection affect investment and business valuation?

Well-protected IP significantly enhances business valuation and investment attractiveness. Investors evaluate IP portfolios when making investment decisions, and strong IP protection provides competitive advantages and revenue opportunities through licensing. A comprehensive IP strategy should align with your business objectives and investment goals.

What can I do if someone infringes my intellectual property rights?

IP rights holders may pursue civil remedies for infringement, including:

- Injunctive relief: Court orders to prevent continued infringement

- Monetary damages: Compensation for losses incurred

- Account of profits: Recovery of profits the infringer gained

- Delivery up or destruction: Removal of infringing materials from the market

Should I consult a lawyer for intellectual property matters?

Early consultation with qualified legal counsel ensures optimal protection strategies tailored to your specific business requirements.

Need Expert Legal Guidance?

Our experienced legal team specializes in intellectual property protection for businesses of all sizes. We help startups, SMEs, and investors navigate Ghana's IP landscape effectively, ensuring your innovations and brands receive the protection they deserve.

Contact us today to schedule a consultation and develop a customized IP protection strategy that aligns with your business objectives and budget.

This guide provides general information regarding intellectual property law in Ghana and does not constitute legal advice for specific circumstances. Professional legal consultation is recommended for particular matters.

Understanding Tax Filing Obligations for Companies in Ghana

Corporate Tax

Companies registered in Ghana are required to pay corporate tax on the company's annual profit. The current corporate tax rate is 25%.

Filing Process for Corporate Tax:

Provisional Assessment: The Company will be provided a provisional assessment of the company's tax liability based on its revenue, as determined by the Commissioner at the start of the financial year. This is an initial assessment that serves as a preliminary estimation.

The taxpayer is required to pay the assessed amount based on the initial assessment in four quarters of the related year.

Preparation of Financials: At the end of the financial year, the Company is required to prepare its financial accounts, including the profit and loss account, balance sheet, and cash flow statement, which should be audited and signed off by an auditor.

Submission of Company Income Tax Return and Financial Statement: The Company is required to submit a Company Income Tax Return along with the financial accounts to the GRA. This return must be completed using the prescribed form and filing is due by April of the following year.

Final Assessment: The GRA issues a final tax assessment based on the submitted financial accounts. Any outstanding tax liabilities must be settled by the company.

Personal Income Tax (P.I.T)

Individuals are required to pay Personal Income Tax (PIT) on the total of their chargeable income, which encompasses all income generated from employment, business or investments less any allowable deductions for the year.

Personal Income Tax is applied based on graduated tax rates rather than a flat rate. This means that the tax payable is dependent on the taxpayer's income. Consequently, higher earnings result in a proportionally higher tax obligation.

Filing Process for Personal Income Tax:

Provisional Assessment: The taxpayer receives a provisional assessment of tax, which is based on an initial evaluation of the individual's chargeable income. This provisional assessment provides an estimated amount that the taxpayer is required to pay.

Submitting an Income Tax Return: at the end of the period, the taxpayer is required to submit an income tax return for the assessment year. This return must be completed using the prescribed form and submitted no later than 4 months after the conclusion of the basis period.

Final Assessment: Upon receiving the return of income and any other relevant information, the Commissioner will proceed to make a final assessment of the taxpayer's chargeable income and determine the tax payable based on this assessment. Any outstanding payments will be communicated to the taxpayer, who is required to settle them promptly.

Pay–As–You–Earn (PAYE):

Employers in Ghana are required to withhold income tax from the wages and salaries of their employees (Pay-As-You-Earn or PAYE) and remit the withheld taxes to the Ghana Revenue Authority. The PAYE tax is graduated depending on the income range.

All employers are also required to file annual returns of employees with the GRA, disclosing income paid to and tax withheld from each employee, within four months of the end of the calendar year.

Filing Process for Pay–As–You–Earn (PAYE)

Employers are required to deduct Pay As You Earn (PAYE) from the monthly salary of each employee.

The accumulated PAYE amount for the month is to be remitted to the Ghana Revenue Authority (GRA) at the end of the month.

Employers must fill out and submit monthly PAYE deductions returns along with a schedule detailing the names and Ghana card numbers of employees and the corresponding amounts paid. Payment of the amount due must be paid to the GRA.

Consequences for Non-Compliance

Companies that fail to comply with their tax filing obligations within the stipulated timeframe become liable to administrative penalties for the duration that the default continues.

By understanding the filing requirements, adhering to deadlines, and seeking appropriate legal assistance, companies can ensure compliance with Ghanaian laws and avoid potential penalties for non-compliance.

For more information on how we can assist your company in meeting regulatory requirements and ensuring compliance with the law, please contact us at contact@olaryealaw.com / +233 (0)201068192.

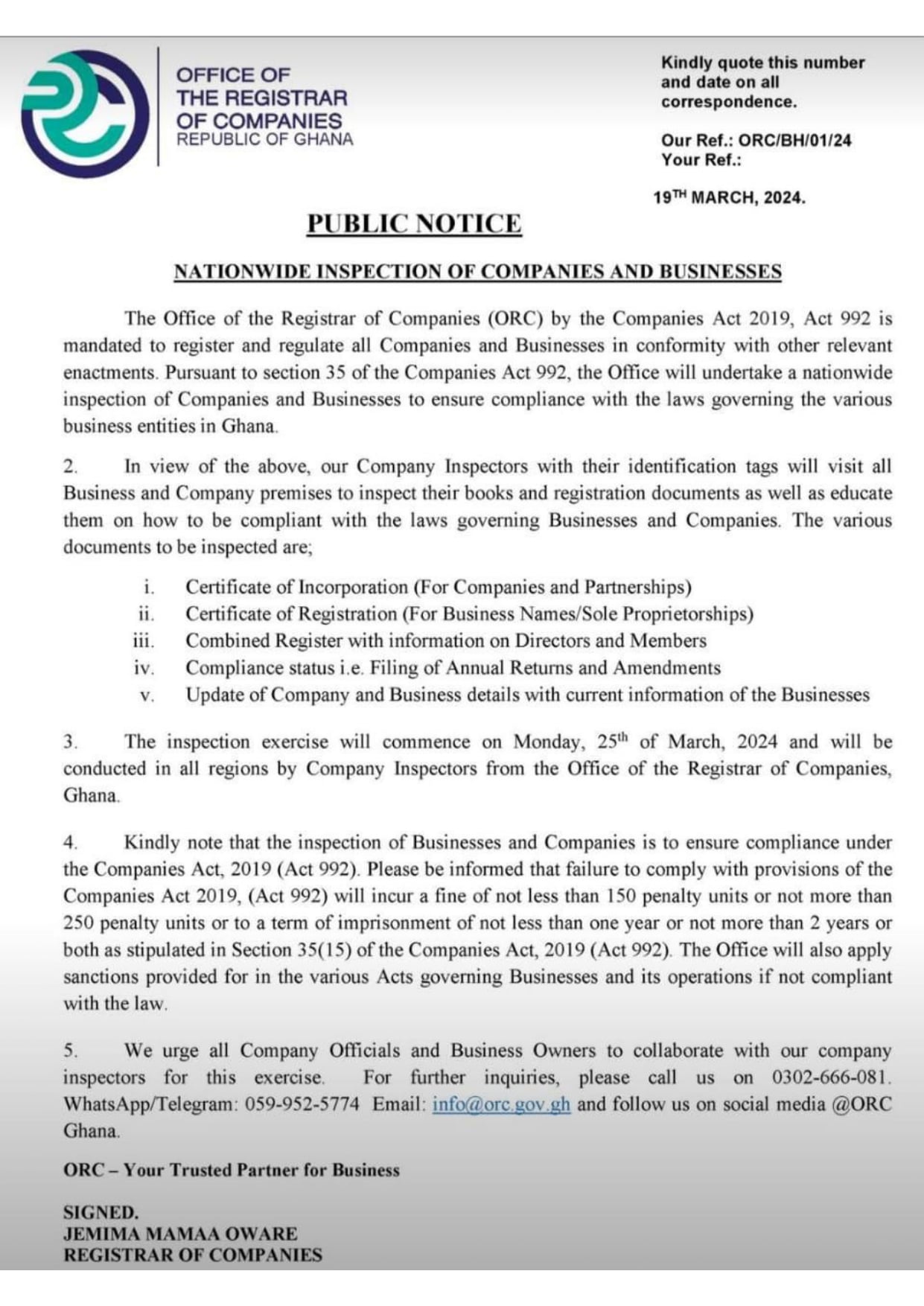

Notice of Nationwide Inspection of Companies and Businesses in Ghana

Attention all business owners and companies operating in Ghana! 📝

The Office of the Registrar of Companies in Ghana is set to conduct an inspection exercise to ensure compliance with the Companies Act 2019, Act 992.

Starting Monday, March 25th, 2024, inspections will be carried out in all the regions of Ghana to ensure adherence to regulatory provisions.

The various documents to be inspected are:

- Certificate of Incorporation (for Companies and Partnerships)

- Certificate of Registration (for Business Names / Sole Proprietorships)

- Combined Register with information on Directors and Members

- Compliance status i.e filing of Annual Returns and Amendments

- Update of Company and Business details with current information about the Business.

Failure to comply with the provisions of the Companies Act 2019 (Act 992) could lead to fines or terms of imprisonment of not less than one year or both.

Stay proactive and ensure your business is up to date with all statutory requirements to avoid any inconvenience.

#GhanaBusiness #Compliance #Regulatoryupdate #legal #regulatory

Understanding Statutory Filing Obligations for Companies in Ghana

Annual Returns

Companies registered in Ghana are required by law to file their returns with the Companies Registry annually. This statutory requirement applies to all registered entities operating in the country. Newly formed companies are however required to file their returns at least eighteen (18) months after the date of incorporation.

Filing Process

As part of the filing process, it is also crucial to prepare and submit the audited financial statement of the company, indicating a comprehensive overview of the company’s financial performance over the reporting period.

The filing process also involves filling out the prescribed form for filing annual returns with essential company information. These include information on the past and present shareholders, particulars of directors and secretary, registered business address, particulars of shares and beneficial ownership information of the Company.

The completed annual returns form and the audited financial statement are submitted to the Registrar General Department for filing.

Consequences for Non-Compliance

Companies that fail to comply with the requirement of filing their annual returns within the stipulated timeframe become liable to administrative penalties for the duration that the default continues.

By understanding the filing requirements, adhering to deadlines, and seeking appropriate legal assistance, companies can ensure compliance with Ghanaian regulations and avoid potential penalties for non-compliance.

For more information on how we can assist your company in meeting regulatory requirements and ensuring compliance with the law, please contact us at contact@olaryealaw.com / +233 (0)201068192.

Legal and Regulatory Requirements for Registering as a Value-Added Services (VAS) Provider in Ghana

What are Value-Added Services in Telecommunications?

Value Added Services (VAS) may be described as enhanced non–core telecommunication services that add value to the standard telecommunication offerings like voice calls, data and text provided by Telecom Networks to subscribers.

Some examples of Value-Added Services (VAS) include call waiting, call forwarding, multiparty conferencing, voice mail, mobile payment systems and m-commerce-based services, Mobile advertising, mobile health and mobile insurance services, location-based services, online gaming services and vehicle tracking services.

What are the relevant government bodies that regulate Value Added Services in Ghana?

The provision of Value-Added Services in Ghana is regulated by the National Communications Authority (NCA).

What are the requirements for registering as a Value-Added Service Provider in Ghana?

To establish and operate as a VAS provider in Ghana, the entity must first be incorporated within the country. Following the incorporation, the company must apply to the NCA for registration as a recognized Value-Added Service Provider before commencing its services.

Are there any requirements for ownership by indigenous persons or entities?

A company with foreign participation established to provide Value Added Services in Ghana, is required to have a Ghanaian partner who holds at least thirty per cent (30%) equity participation in the joint enterprise.

Registration Requirements

To commence the Value-Added Services (VAS) registration in Ghana, an application for registration using the prescribed form must be submitted to the Regulatory Authority together with the following information:

- Corporate Profile: An applicant must provide the company registration documents, including the certificate of incorporation, articles of association, Information on the experience and qualifications of key personnel involved in the VAS operations and any other necessary legal documents.

- Type of value-added services to be provided: An applicant is required to provide service description details of the VAS offerings and technical implementation layout.

- Market Plan: This must include the applicant's target group, area of coverage and roll-out plan.

- Particulars of the equipment to be used and Type approval certificates,

- Company’s audited financial returns: Start-ups are required to submit their financial forecasts while existing companies must submit a minimum of one year audited financial returns.

- Letter of Commitment indicating the applicant's compliance with existing ITU regulations, communications laws of the country, and other relevant rules, guidelines, and regulations.

- Fees: The applicant is required to pay the prescribed fees as stipulated by the regulatory authority. The specific fee amount will be determined by the authority.

By fulfilling these requirements and paying the applicable fee, the company can proceed with the application for Value Added Services (VAS) registration in Ghana.

Doing Business in Ghana: Guide to Incorporating a Startup Company in Ghana

There are several advantages to incorporating a startup business in Ghana.

Some of the benefits are, firstly, as a separate legal entity, the company’s founders and shareholders are not personally liable for the company’s financial debts or legal issues. The personal assets of the founders and shareholders are therefore protected.

Secondly, incorporation offers the company perpetual existence, which enables the company to continue operating following the exit of its founders or shareholders.

Another benefit of incorporating a startup company is that it enhances the startup’s credibility and provides a more formal business structure, which ultimately makes investors and lenders willing to invest in the company.

Types of Companies that can be Incorporated in Ghana

Companies in Ghana may be categorized as limited by shares, limited by guarantee or unlimited companies. They may also be either private or public companies.

Below is a guide on the types of companies that founders can incorporate and the registration process.

1. Company Limited by Share

This refers to a company that is registered with share capital. It provides limited liability protection to its members, which means the liabilities of the member(s) of the company are limited to the amount unpaid on the shares held respectively by them.

General Requirements

The general minimum requirements for incorporating companies limited by shares in Ghana are as follows:

- The company should have at least one (1) shareholder.

- The company's shareholder(s) may be an individual or a corporate body.

- The company must have a minimum of two (2) directors.

- At least one (1) of the directors of the company must be present in Ghana.

- The company must have a company secretary and an auditor.

Minimum Capital requirements

- The minimum capital for a company registered with Ghanaian shareholders is five hundred Ghana Cedis (Gh¢500).

- For companies registered with foreign shareholders, the minimum capital requirement is as follows:

- Joint venture with Ghanaian participation: Two Hundred Thousand Dollars (US$200,000).

- Hundred per cent (100%) foreign ownership: Five Hundred Thousand Dollars (US$500,000).

- A company engaged in trading activities: One Million Dollars (US$1,000,000).

Registration Process

Business name selection and name search

The first step in registering a Company in Ghana involves conducting a name search on the proposed business name at the Registrar Generals Department (RGD). This is to confirm the availability of the proposed name. If the proposed name is unavailable, the company must select a new name.

Obtaining Tax Identification Numbers (TIN)

Once the name is confirmed to be available, the next step is to obtain a Tax Identification Number (TIN) from the Ghana Revenue Authority (GRA) for the Company and all its Directors, Officers and Shareholders who may not have Tax Identification Numbers. This is done by filing a tax registration form.

Preparation of the Company’s Constitution:

The Company’s Constitution must be prepared and submitted to the Registrar of Companies as part of the incorporation process. The Constitution is equivalent to the Articles of Incorporation.

The company’s Constitution must contain information such as:

- the name of the Company,

- the name of the first directors of the company.

- the number of registered shares of the company.

- It should also contain a declaration that the liabilities of the members are limited.

- It must be signed by the members.

Filling and submission of incorporation documents:

The prescribed form for registering a limited liability company is Form 3.

The completed Form 3 together with the company’s Constitution, Beneficial Ownership declaration form (BO form), directors' consent form (form 26A), the company secretary’s consent form (form 26B) and directors' statutory declaration form (form 26C) must be submitted to the Registrar of Companies for processing.

The applicable registration fee and capital duty charged at 0.5% of the company’s stated capital must be paid at the Registrar Generals Department.

Issuance of Certificate of Incorporation

Once the Registrar of Companies is satisfied with the accuracy of the documents submitted, a Certificate of Incorporation will be issued within two (2) weeks.

2. Unlimited Company

An unlimited Company refers to a company which does not have a limit on the liability of its members. This means that the shareholders of the company assume legal responsibility for the debts and liabilities of the business.

The requirements and process for incorporating an unlimited company in Ghana are generally similar to the process outlined above for the registration of a limited liability company.

3. Company Limited by Guarantee

This refers to a company that is incorporated without share capital. The liabilities of its members are limited to the amount that the members undertake to contribute to the company’s assets in case of liquidation, for the payment of the company's debts and liabilities. The purpose of a company limited by guarantee is not to generate profit.

Examples of entities that may be registered as companies limited by guarantee are Non-Government Organizations (NGOs), charities, churches and associations.

Requirements

A company limited by guarantee must have:

- at least one subscriber

- an executive council made up of at least two (2) executive members and a maximum of twelve (12) members.

- A company secretary.

- An auditor.

Registration process

The registration process for a company limited by guarantee is similar to the process outlined above for incorporating a company limited by shares.

Name Search

The process begins with conducting a name search to confirm the availability of the proposed business name. The RGD may reject a name which is similar to the name of an already existing business entity or is misleading.

Tax Identification Number

The next stage is the application for Tax Identification Numbers (TIN) for all the members and subscribers of the company who do not have TIN. This is done by filing a taxpayer registration form.

Prescribed Constitution of the Company

The constitution for a company limited by guarantee must include provisions that:

- the liabilities of members are limited.

- The income and property of the company shall be used entirely to promote the objects of the company.

- If the company is liquidation, the members agree to contribute to the assets of the company and the payment of the company’s debts and liabilities up to the limit prescribed by the company’s constitution.

- Any property that is left after the company has discharged its debts and liabilities upon liquidation, will not be distributed among the members but shall be given to another company limited by guarantee that has similar objects or applied to a charitable object.

Filling and submission of incorporation documents:

The prescribed forms for registering a Company Limited by Guarantee in Ghana are Form 3B (for a private company limited by guarantee) and Form 3E (for a public company limited by guarantee).

The completed prescribed form together with the company’s constitution outlining the rules governing the company's activities, a memorandum of association providing information on the purpose of the company and details of guarantors, Beneficial Ownership declaration form (BO form), consent forms for executive council members (form 26A), the company secretary’s consent form (form 26B), consent letter for a certified auditor and statutory declaration form for executive council members (form 26C) must be submitted to the Registrar of Companies for processing. The applicable registration fee must also be paid at the Registrar Generals Department.

Issuance of Certificate of Incorporation

A Certificate of Incorporation will be issued by the Registrar of Companies within two weeks, upon receipt of all the required information, documents, and payment of prescribed fees.

4. External Company

An external company refers to a body corporate formed outside Ghana, which has an established place of business such as a branch or registered office in Ghana. Companies incorporated outside the jurisdiction of Ghana, that intend to operate as an External company must be registered by the Registrar of Companies in Ghana.

Requirements:

The following documents are required to be provided for the registration:

- notarized copy of the Certificate of Incorporation

- notarized Power of Attorney appointing a Local Manager as the company’s duly appointed representative in Ghana. The local manager appointed must be always resident in Ghana.

- copy of the Constitution, Charter, Statutes, Regulations, Memorandum and Articles of Association, or any other instrument constituting or defining the Constitution of the company, in a language acceptable to the Registrar.

- notarized statement providing details of the Beneficial Owners of the company.

- the address of the Company’s registered or principal office in the country of incorporation and its address and principal place of business in Ghana.

The documents submitted must be in English and duly notarised by a Notary Public in the country of incorporation or duly stamped and sealed by the relevant Embassy or Consulate of Ghana from the said country of origin.

It is recommended that you seek legal advice before incorporating a company in Ghana to obtain guidance on the legal aspects of company formation and the type of company that is best suited for your business, to ensure that all the paperwork is processed properly and generally to confirm that the business is established in compliance with the law.

Legal and Regulatory Framework for Setting Up a Fintech Startup in Ghana.

Ghana is an epitome of technological growth and has one of the fastest-growing financial technology (Fintech) ecosystems in Africa. As everything becomes increasingly interconnected, the way we conduct commercial and recreational activities is completely changing.

In Ghana, Financial Technology (Fintech) startups are on a path of growth with enormous opportunities.

The growing mobile and smartphone usage provides an excellent opportunity for the promotion of financial inclusion by Fintechs, to people without access to traditional financial services.

Regulation of Fintechs in Ghana

The financial technology (Fintech) ecosystem in Ghana is regulated by the Bank of Ghana. The key legislation that governs payment service providers, dedicated electronic money issuers, their affiliates and agents is the Payment Systems and Services Act, 2019 (Act 987).

The Act requires companies seeking to carry out payment service business or issue electronic money to be duly licensed by the Regulator.

Licensing Requirements

i. Company Profile

In order to operate as a fintech startup in Ghana, the first step is for the company to be duly incorporated under the laws of Ghana at the Registrar Generals Department (RGD).

An overview of the company, it’s company incorporation documents and summary of services to be offered must be submitted to the Regulator as part of the licensing process.

ii. Governance

The company must provide information about the shareholders, their respective percentage holding in the company, nationality, copies of share certificates and attestation from a notary public confirming foreign ultimate beneficial owners with 10% or more of the total share ownership or voting rights.

The profile of the Directors and key management personnel as prescribed under the Payment Systems and Services Act, 2019 (Act 987) as well as an organizational chart must also be provided. The Payment Systems and Services Act, 2019 requires that businesses seeking to operating as a Payment Service Providers must have a minimum of three (3) directors.

iii. Business Plan

A comprehensive business plan covering the business overview, market analysis, products and services to be offered, the company’s on-boarding process, proposed fees to be charged and a five -year projection for the business must also be submitted by the founders as part of the application process.

iv. Systems and Technology

The following Information, Communication and Technology (ICT) systems must be employed:

- ICT policy framework

- Security and control (including transaction monitoring tool, fraud monitoring and detection tool and at least two factor authentication)

- Business continuity program

- Data Protection Certificate

- ISO 27001 certification and compliance where applicable

- PCI DSS Certification and compliance where applicable

- EV-SSI tools where applicable

- Network and Vulnerability assessment/penetration test

- ICT risk assessment and mitigation measures

v. Enterprise Risk Management

The company is required to submit its risk and mitigation measures which cover all operational, market liquidity, fraud, legal, credit and funding risk where applicable, Business Impact Assessment (BIA) and an Anti-Money Laundering (AML)/Combating the Financing of Terrorism (CFT) policy.

vi. Consumer Protection Policy

The Company must also submit its consumer protection policy which should be guided by the Consumer Recourse Mechanism Guideline for Financial Service Providers Act 2017 (Act 987).

License Categories and Permissible Activities for Payment Service Providers and Fintechs in Ghana

There are different categories of licenses for payment service providers and fintechs, based on their nature of business and permissible activities.

1. Electronic Money Issuer:

The permissible activities under this licence category includes Issuance of electronic money, recruitment and management of agents, creation and management of wallet. Wallet based domestic money transfers including transfers to and from bank accounts, cash in and cash out transactions, investment, savings, credit products only in partnership with banks, insurance and pension products only with authorised insurance and pension companies.

2. Payment Service Provider (PSP) Scheme

The activities permitted under this category of license are routing of payment transactions, authorisation, and settlement requests from merchants, acquiring and issuing banks.

3. Payment Service Provider (PSP) - Enhanced License

The PSP (Enhanced License) allows for the Aggregation of merchant services, processing services, provision of hardware and software, printing and personalisation of EMV Cards, Inward International remittances services, merchant acquiring, POS deployment, and Payment aggregation.

4. Payment Service Provider (PSP) - Medium License

Payment Gateway and Portals/Payment aggregation which is connected to Enhanced PSP. Training and support of merchants. Printing of non-cash payment instrument, development of market platforms, payment application/solutions for Credit, Savings and Investment products in partnership with Banks.

5. Payment Service Provider (PSP) - Standard License

A payment application solution/ development, merchant development platform, a payment solution.

6. Payment and Financial Technology Service Provider (PFTSP)

The permitted services under the PFTSP license include Digital product development, delivery and support services for Payment, Savings, Insurance, Investment, Credit scoring predictive analytics, AML/CFT centralized platform, Fraud management services, Know Your Customer (KYC) and Customer Due Diligence (CDD) authentication services.

Conclusion

Startup businesses seeking to operate within the Ghanaian fintech industry must comply with the legal and regulatory framework governing the industry to prevent regulatory sanctions and reputational damage which may impact their revenue.

O-Laryea Law provides free consultation to fintech startups, entrepreneurs and investors in Ghana. We can assist with legal and regulatory guidance to enable you succeed in the fintech industry in Ghana.

Term Sheet for Private Equity Investments

What is a Term Sheet

A term sheet is a document which provides a summary of agreed terms and conditions in a proposed investment transaction. It contains the key elements of the transaction and facilitates the drafting of final comprehensive legal documents.

Legal Effect

Term sheets are generally non-binding and may be subject to the confirmation of satisfactory completion of due diligence or negotiation of additional conditions. However, some clauses in the term sheets such as exclusivity period and confidentiality clauses are legally binding.

Term Sheet Provisions

The contents of a term sheet may vary based on factors such as the kind of investment transaction and the stage of investment. The clauses in a term sheet can be broadly categorised into funding, corporate governance and exit provisions.

- Funding

Funding provisions provide details about the investment. These usually include information about the investor and the company, total funds being invested and a description of the type of securities being issued, for example, common shares or preference shares. Details on share price and number of shares being issued are also captured under the funding provisions.

- Corporate Governance

Under corporate governance, terms relating to voting rights, board composition and information rights are detailed. The voting rights outline the rights of the investor to vote on corporate matters whiles board composition specifies the arrangements on nominating directors of the company. Information rights indicates the extent of the company’s information disclosure requirements to the investors.

- Other Provisions

Other provisions that may be included in a private equity investment term sheet are:

Pre-emptive right which refers to the right of existing shareholders to be offered the first option to purchase shares in the event of a proposed sale, transfer or disposal of shares in the company.

Tag-along-rights which refers to the right of minority shareholders to sell their shares in the company on the same proportional conditions.

Fintech License in Ghana

A company that intends to operate as a Dedicated Electronic Money Issuer (DEMI), Payment Service Provider (PSP) or a Payment and Financial Technology Service Provider (PFTSP) in Ghana must be licensed by the Bank of Ghana.

License Categories

There are six (6) license categories. Each license category specifies the permissible activities that can be undertaken.

The license categories and related permissible activities are as follows:

1. Dedicated Electronic Money Issuer

Permissible activities:

- Recruitment and management of agents

- Creation and management of wallet

- P2P On Net / Off Net

- Cash-In and Cash-Out

- Wallet based domestic money transfers including transfers to and from bank

accounts

- Investment, savings, credit, insurance and pension products (ONLY in

partnership with banks and duly regulated institutions)

- Mobile money merchant acquiring

- Termination of Inbound International Money Transfer

2. Payment Service Provider - Scheme

Permissible activities:

- Domestic Card Brand Associations e.g. Gh-Link

- Switching & routing of payment transactions and instructions

3. Payment Service Provider – Enhanced

Permissible activities:

- All permissible activities for PSP-medium license

- Marketplace for financial services offered by duty regulated financial service

providers

- Merchant acquiring and merchant aggregation

- Payment processing

- Printing and personalization of EMV Cards

- Inward International remittances services

- Providing 3rd party payment gateways services

- Limited use closed loop virtual cards (funded via refunds, rewards & user’s

other accounts)

4. Payment Service Provider- Medium

Permissible activities:

- Connection to an Enhanced PSP to offer the following services

- All permissible activities for PSP-standard license

- Payment aggregation which is connected to Enhanced PSP

- Biller/Merchant Aggregation

- POS Deployment

- Printing of non-cash payment instruments eg. cheques

- Mobile payment Apps (with liability shift on PSP Enhanced)

5. Payment Service Provider- Standard

Permissible activities:

- Connection to an Enhanced PSP to offer Mobile payment Apps service.

This Category of license is reserved for Ghanaians and wholly owned Ghanaian

entities.

6. Payment and Financial Technology Service Provider (PFTSP)

Permissible activities:

- Digital Product development, delivery and support services

- Credit scoring predictive analytics

- AML/CFT centralised platform

- Fraud Management services

- Know your Customer(KYC) and Customer Due Diligence (CDD) authentication

services

- Connection to DEMIs, PSPs, Banks and Financial Institutions

Incorporation of Non-Government Organisation (NGO) in Ghana

Non-Governmental Organizations (NGO) or Non-Profit Organizations (NPO) are incorporated in Ghana as Companies Limited by Guarantee. These companies are set up to fulfil non-commercial or charitable purposes.

Following its incorporation as a Company Limited by Guarantee, an NGO / NPO is required to register with the Non-Profit Organization Secretariat in Ghana.